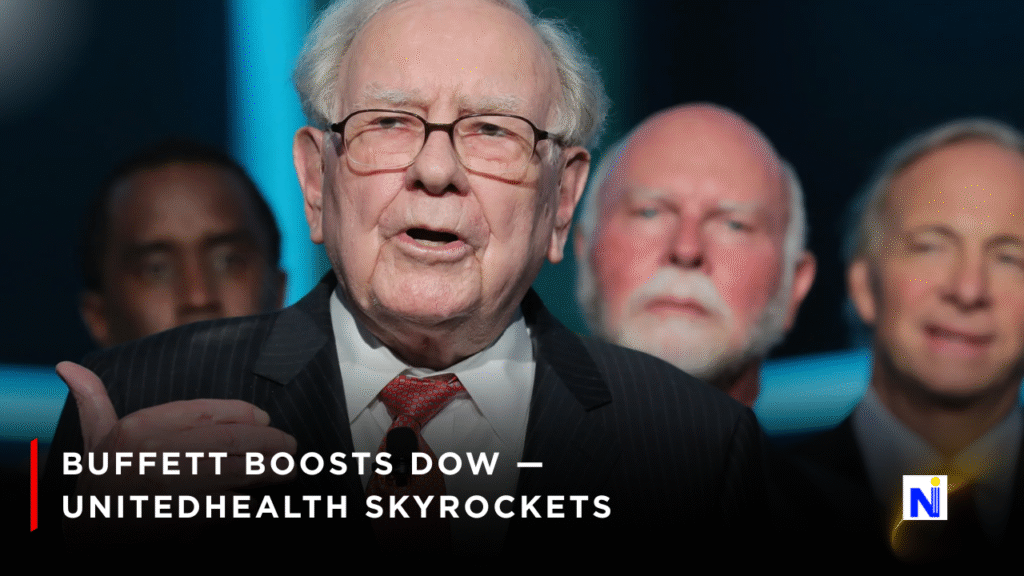

When Warren Buffett moves, Wall Street listens and today was no exception. The Dow Jones rallies this Friday morning after Buffett’s Berkshire Hathaway revealed a massive $1.57 billion position in UnitedHealth Group. It’s the kind of market jolt that makes traders sip their coffee a little faster.

Retail Sales Hold Steady — No Shocks, No Surprises

Friday kicked off with fresh retail sales data from the Commerce Department. Numbers landed exactly where analysts expected:

- Retail sales: +0.5% in July

- Excluding autos: +0.3%

- June revision: from 0.6% to 0.9%

While it’s not the kind of headline that shakes the markets, it’s the consistency that investors tend to appreciate. Higher revisions for June also give a small boost to the economic mood, signaling consumers are still spending despite mixed economic signals.

The Buffett Effect: UnitedHealth Skyrockets

Late Thursday, SEC filings revealed Berkshire Hathaway had bought just over 5 million shares of UnitedHealth at an average of $311.97 each. The total? A cool $1.57 billion.

The impact was immediate:

- UnitedHealth surged over 11% premarket.

- Dow Jones futures jumped 0.6%.

- Health sector stocks enjoyed a knock-on effect.

Buffett also expanded positions in D.R. Horton (+3%) and Nucor (+6%), while trimming holdings in Apple and Bank of America. It’s a reminder that even the “Oracle of Omaha” keeps his portfolio moving like a game of market chess.

Winners and Losers on the Dow

Big movers today:

- Amazon (AMZN): +0.6%, eyeing a 4-day win streak.

- Salesforce (CRM): +1.4%, climbing after upbeat guidance.

- Caterpillar (CAT): -0.9%, facing commodity price headwinds.

Tech under pressure:

Applied Materials plunged 13% and Sandisk tumbled 10% after earnings results disappointed investors.

Economic Data Round-Up

Friday’s data drop was a mixed bag:

- Empire State Manufacturing Index: Climbed to 11.9 (vs. 0.5 forecast)

- Import Prices (July): +0.1%

- Export Prices (July): +0.1%

- Consumer Sentiment: Expected to tick up to 62.1 in August

Stable inflation data and improving sentiment suggest the Fed might keep rates steady, but market watchers know — the Fed’s next move is never a sure bet.

What This Means for Investors

Buffett’s bet on UnitedHealth is more than just a headline it’s a confidence signal in the healthcare sector’s resilience. Add in steady retail sales and a surprisingly strong manufacturing report, and it’s no wonder Dow Jones rallies were the talk of Friday morning.

Still, the divergence between Dow strength and tech weakness is worth noting. As Amazon and Salesforce push higher, chip and storage names are taking hits — a sign that sector rotation may be underway.

Optimizing Your Market Watch

For readers following along, remember to:

- Diversify holdings even Buffett trims his winners.

- Watch economic reports for market sentiment clues.

- Keep an eye on sector leaders during rallies.

(If you’re publishing this with images, make sure to use alt text like “Warren Buffett UnitedHealth stake boosts Dow Jones” to keep your SEO in top shape.)

Today’s session is shaping up as a classic example of how a single high-profile move can swing market sentiment. Warren Buffett’s $1.57B UnitedHealth buy sent ripples through the Dow, giving investors a reason to smile heading into the weekend.