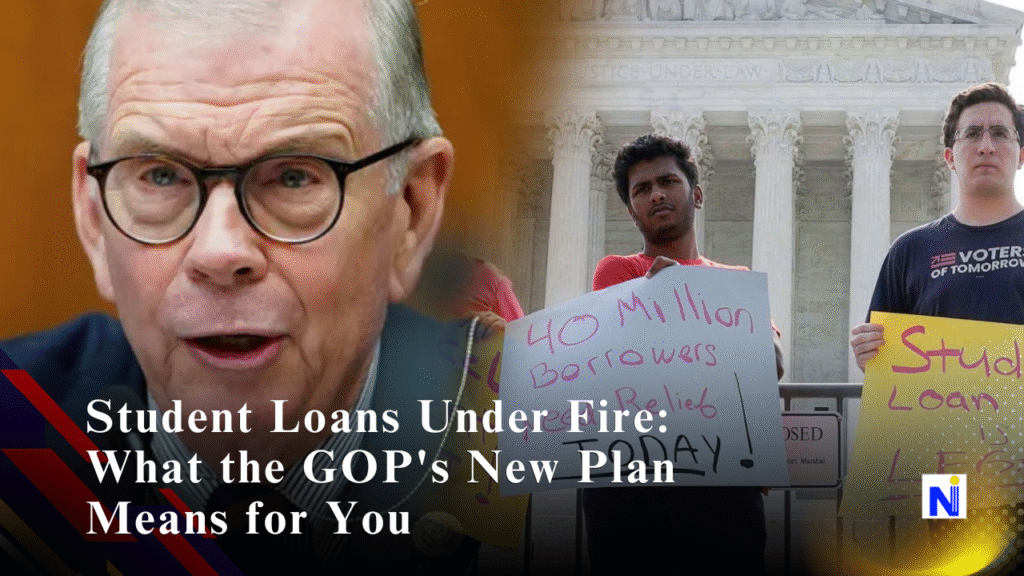

Let’s be honest—student loans have long been a confusing maze of acronyms, repayment plans, and shifting rules. Just when you thought you had a handle on it, here come major changes. House Republicans have unveiled a sweeping proposal that could redefine how families pay for college and how borrowers repay student debt. Whether you’re a recent grad, a parent of a future student, or just someone who enjoys a good policy debate, this one’s worth unpacking.

The Heart of the Matter: What’s in the Proposal?

Republicans are pushing for what they call a fiscally responsible transformation of the federal student loan system. While that might sound dry, the impact is anything but. The plan aims to:

- Curtail Pell Grant expansion

- Lower federal loan limits for parents and graduate students

- Replace existing repayment plans with two streamlined options

- End student loan forgiveness after 20–25 years and extend repayment to 30 years

A Closer Look at the Repayment Assistance Plan (RAP)

Out with SAVE and IBR, and in with RAP—the Repayment Assistance Plan.

Under RAP:

- Your payment is calculated using your Adjusted Gross Income (AGI).

- Payments range from 1% to 10% of AGI, depending on income level.

- Borrowers can deduct $50 per child to reduce their payment.

- There’s a minimum payment of $10/month.

Here’s the RAP Formula in Action:

| AGI Range | Payment Rate |

|---|---|

| $10,001–$20,000 | 1% |

| $20,001–$30,000 | 2% |

| $30,001–$40,000 | 3% |

| $40,001–$50,000 | 4% |

| $50,001–$60,000 | 5% |

| $60,001–$70,000 | 6% |

| $70,001–$80,000 | 7% |

| $80,001–$90,000 | 8% |

| $90,001–$100,000 | 9% |

| Over $100,000 | 10% |

Even though this plan includes interest and principal subsidies to keep balances from ballooning, the total repayment under RAP can still be significantly higher over time.

Comparing RAP vs. SAVE vs. IBR: Who Wins?

Let’s run a few examples to see how the numbers stack up.

1. Low-Income Borrower with Children

- AGI: $25,000

- Kids: 2

- Loan Balance: $30,000

| Plan | Monthly Payment | Total Paid | Forgiveness Time |

| RAP | $10 | $3,600 | 30 years |

| SAVE | $0 | $0 | 20–25 years |

| IBR | $0 | $0 | 20–25 years |

Even though RAP prevents your balance from growing, you still end up paying $3,600 for a loan you’ll never fully repay.

2. Moderate-Income, No Kids

- AGI: $60,000

- Loan Balance: $30,000

| Plan | Monthly | Total Paid | Years to Repay |

| RAP | $250 | $60,000 | 20 years |

| SAVE | $217.63 | $70,512 | 27 years |

| IBR | $311.75 | $50,191 | 13 years |

In this case, IBR is cheapest overall, while SAVE offers the lowest monthly payment.

What About the Standard Plan?

For those who prefer predictability, the new standard plan offers equal monthly payments based on your loan size:

- Under $25,000: 10 years

- $25,000–$50,000: 15 years

- $50,000–$100,000: 20 years

- Over $100,000: 25 years

However, this option isn’t eligible for Public Service Loan Forgiveness (PSLF), which could be a dealbreaker for many.

Potential Trade-Offs for Borrowers

Let’s break it down:

Pros:

- No negative amortization under RAP

- Principal reduction feature helps pay down debt

- Simplifies repayment options

Cons:

- Higher total repayment for low-income borrowers

- 30-year forgiveness is a long haul

- May replace more generous existing plans

What Happens to Current Borrowers?

Here’s the silver lining: if your loan was issued before July 1, 2026, you can likely stick with your current plan. Borrowers in the now-defunct SAVE plan, however, may be forced to choose between RAP or the new standard plan.

Public Service Loan Forgiveness Still Stands—But With a Catch

Borrowers pursuing PSLF can still qualify using RAP. But that $10 minimum payment can add up even if your income is low. Compared to $0 payments under SAVE or IBR, this change might feel like a small, but frustrating, jab.

Final Thoughts: A Fork in the Road for Student Debt

Look, student loans were never meant to be easy. But with Republicans proposing a radical shift in repayment structures and aid eligibility, the road ahead could get bumpier for some and clearer for others. Whether these proposals become law remains to be seen—but if they do, new borrowers in 2026 could be in for a very different repayment experience.

Let us know what you think—are these changes overdue or out of touch? Share your thoughts in the comments!

FAQs: Republicans’ Student Loan Plan

1. Who will be affected by the Republicans’ student loan plan?

Primarily new borrowers after July 1, 2026. Existing borrowers can generally stay on their current plans unless they were enrolled in SAVE.

2. Is the Repayment Assistance Plan (RAP) better than SAVE or IBR?

Not for most low- to middle-income borrowers. RAP often results in higher total payments over a longer time.

3. Can I still get student loan forgiveness under the new plan?

Yes, but only after 30 years with RAP. PSLF forgiveness after 10 years is still available.

4. Will Pell Grants be eliminated?

No, but access may be restricted. The plan could reduce eligibility for certain households.