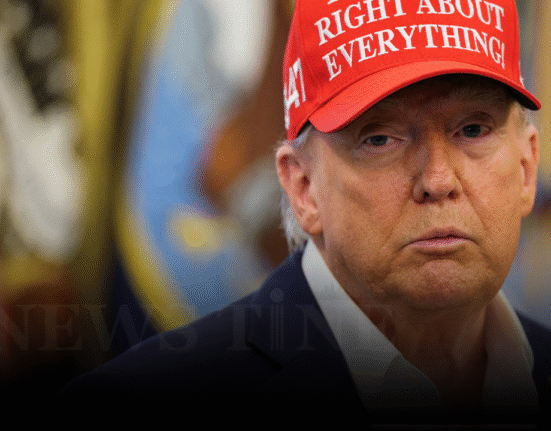

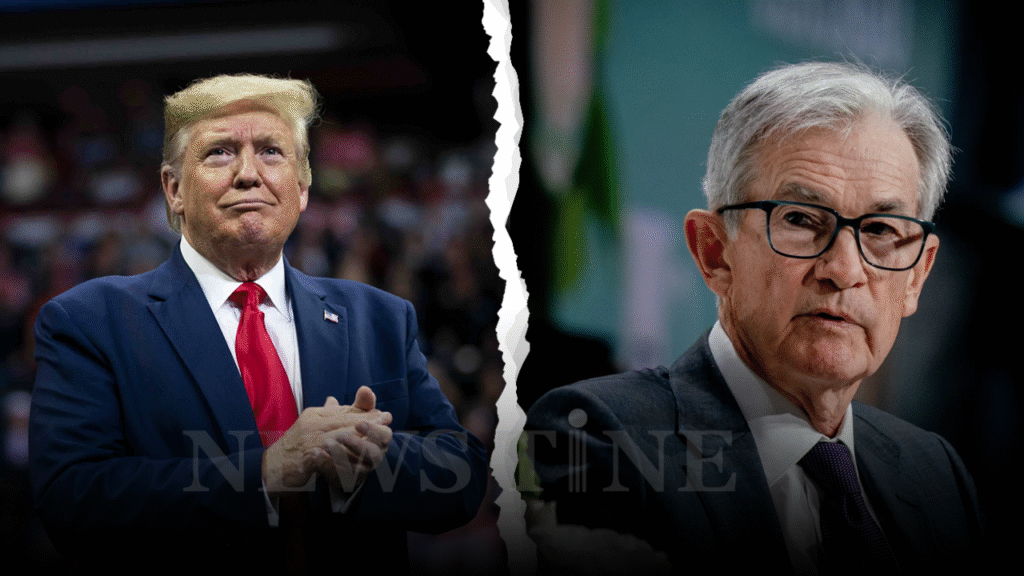

Former President Donald Trump has never been one to mince words—and his latest broadside against Federal Reserve Chair Jerome Powell is no exception. On August 1, 2025, Trump lit up Truth Social with a scathing message: if Powell refuses to lower interest rates, the Fed Board should assume control. It’s the kind of fiery statement that grabs headlines but also raises deeper questions about the independence of the U.S. central bank, market stability, and what comes next for inflation policy. In this post, we’ll unpack the facts, the history, and the real stakes behind Trump’s explosive comments about Federal Reserve leadership and interest rate policy.

Trump vs. Powell: The Latest Flashpoint

What Did Trump Say?

“Jerome ‘Too Late’ Powell, a stubborn MORON, must substantially lower interest rates, now. If he continues to refuse, the board should assume control, and do what everyone knows has to be done!”

That’s the quote—capital letters and all—from Trump’s Truth Social post. His frustration stems from the Fed’s decision on July 30, 2025, to hold interest rates steady despite growing political pressure to lower them. The 9-2 vote marked the first notable split among the Fed’s Board of Governors in over three decades.

Why It Matters

- Economic Impact: Interest rates directly affect mortgages, credit cards, and business loans.

- Inflation Concerns: Powell remains cautious due to lingering inflation fears, a hangover from the post-pandemic economy.

- Political Pressure: Trump’s statement could signal a more aggressive stance toward monetary policy if he wins re-election.

The Fed’s Recent Decision: A Snapshot

| Date | Decision | Vote | Key Reason |

|---|---|---|---|

| July 30, 2025 | Held rates steady | 9-2 | Inflation risk, economic data lag |

| March 2022 | Raised rates by 25 basis pts | Unanimous | Start of inflation control cycle |

Powell’s Position

Powell emphasized at the post-decision press conference:

“Premature rate cuts could risk undoing the progress we’ve made against inflation.”

This aligns with his long-standing approach since 2022, when he called inflation a “severe threat” during his confirmation hearing.

Can the Fed Board Override Powell?

Understanding Fed Governance

- The Board of Governors has 7 members, nominated by the President and confirmed by the Senate.

- The Chair leads the Fed but is still one vote among seven.

- Traditionally, decisions are consensus-driven to maintain credibility and market trust.

Trump’s suggestion that the Board should override Powell isn’t technically impossible—but it would shatter long-held norms of central bank independence.

Historical Context: When Politics Meets Monetary Policy

- 1933: FDR used political pressure to take the U.S. off the gold standard.

- 1970s: President Nixon reportedly leaned on Fed Chair Arthur Burns to keep rates low before re-election.

- 2020-2021: Trump publicly criticized Powell for not lowering rates fast enough.

The Principle of Central Bank Independence

Central bank independence is a cornerstone of modern economic policy. Established under the Banking Act of 1935, it aims to insulate monetary decisions from short-term political interests.

Why It’s Important

- Prevents political manipulation for electoral gain

- Maintains market stability and investor trust

- Allows long-term policy planning over reactionary changes

Even hints of political interference can rattle markets. As one financial analyst tweeted:

“If the Fed loses independence, say goodbye to credible inflation targeting.”

Trump’s Economic Legacy and Strategy

Trump’s economic playbook has long favored lower interest rates, strong growth, and aggressive deregulation. As he eyes another term, pressuring Powell—or replacing him—may become a key campaign narrative.

“Low rates drive growth. Powell doesn’t get that, but I do,” Trump claimed during a recent rally.

This positions him not just in opposition to Powell but potentially to the Fed as an institution.

The Market Reacts

So far, markets have taken a wait-and-see approach. Following Trump’s post:

- Dow Jones dipped 0.8%

- 10-Year Treasury Yield rose to 4.12%

- Gold prices jumped 1.3%

Analysts caution that if Trump’s rhetoric escalates, it could lead to increased market volatility.

Should We Be Worried?

Let’s break it down simply:

- Rates are staying put—for now. The Fed isn’t budging until inflation is under control.

- Trump’s rhetoric may be politically strategic but risks undermining confidence in the Fed.

- Watch the Board: A shift in internal consensus could indicate bigger changes ahead.

Trump’s call for the Fed Board to override Jerome Powell is more than a political outburst—it’s a signal. Whether strategic posturing or a real threat to central bank independence, it has reignited a debate with far-reaching implications. While Powell stays the course, the real question may be how much longer that course remains steady under mounting political pressure.